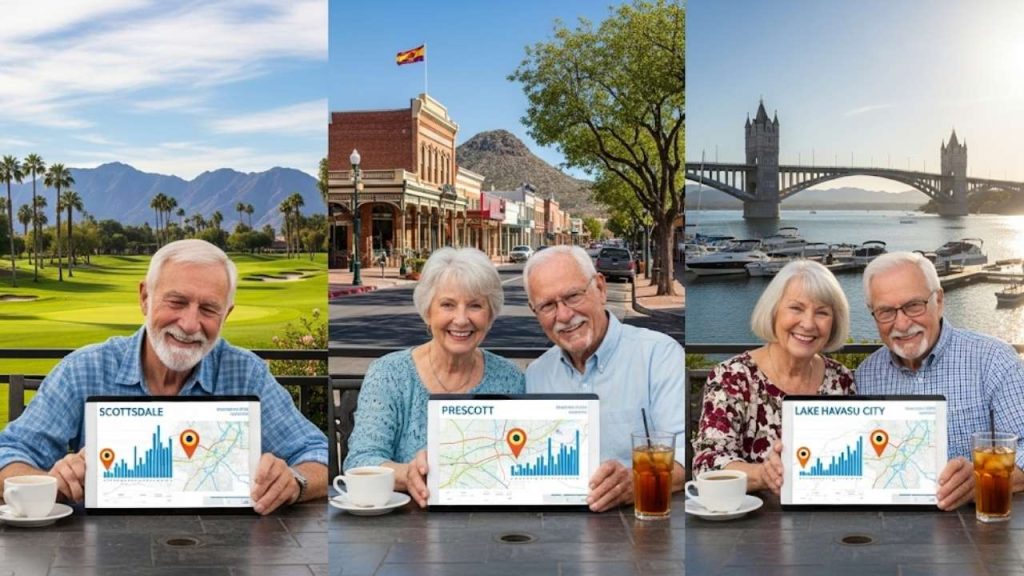

When it comes to retirement, choosing the right city can make all the difference—especially when it comes to the cost of living. In 2025, three cities in Arizona—Scottsdale, Prescott, and Lake Havasu City—have been recognized among the most expensive retirement spots in the United States. These cities offer a blend of sunny weather, beautiful landscapes, and desirable lifestyles, but with a higher price tag.

Whether you’re actively planning your retirement or just curious about these sought-after locations, this article provides an easy-to-understand guide packed with practical advice, accurate data, and a clear breakdown of what it means to retire in these Arizona cities.

Most Expensive Retirement Spots

| Aspect | Details |

|---|---|

| Cities Highlighted | Scottsdale, Prescott, Lake Havasu City |

| Annual Cost of Living | Scottsdale: $81,000+, Prescott: $62,000, Lake Havasu City: $53,000 |

| Population & Age Criteria | Cities with >25,000 population and 25%+ residents aged 65+ |

| Tax Advantages in Arizona | Low income tax (2.5%), no Social Security tax, no estate or inheritance tax |

| Property Tax Rate | Average 0.51%, below national average |

| Median Home Price (Statewide) | $435,300 (November 2023) |

| Arizona Retirement Perks | Warm climate, low taxes, military benefits |

Deciding where to retire is a deeply personal choice that balances lifestyle preferences, finances, and health needs. Scottsdale, Prescott, and Lake Havasu City offer excellent retirement living, but they come with higher costs compared to other regions. Their warm climates, quality healthcare, active communities, and tax benefits make them popular despite the expenses.

Smart planning, budgeting, and researching local options can help you enjoy your retirement comfortably in one of these vibrant Arizona cities.

Why These Arizona Cities Are Among the Most Expensive for Retirement

Arizona has long been a favorite state for retirees, thanks to its comfortable climate, tax-friendly policies, and wide range of lifestyle options. However, these benefits come with some trade-offs—particularly in some of its most popular cities.

Scottsdale

Scottsdale stands out as the priciest retirement city in Arizona, with an annual living cost exceeding $81,000. The city offers a high quality of life, upscale amenities, and stunning desert surroundings. It’s known for luxurious golf communities, fine dining, and premier healthcare services.

Prescott and Lake Havasu City

Following Scottsdale are Prescott and Lake Havasu City, whose annual costs are approximately $62,000 and $53,000, respectively. Prescott is famed for its cooler, mild climate thanks to its higher elevation, along with its small-town charm and vibrant arts and cultural scene. Lake Havasu City attracts retirees seeking a lakeside lifestyle focused on boating and outdoor activities.

What Makes These Cities Costly?

- Housing Market: Median home prices are significantly higher than many other parts of the state, fueled by demand from retirees seeking comfortable and secure living options.

- Amenities and Healthcare: These cities invest in healthcare, safety, recreation, and cultural amenities that enhance the quality of life but add to overall living costs.

- Lifestyle Demand: The appeal of mild winters, outdoor activities, and active community involvement drives up demand, creating upward pressure on prices.

How to Plan for Retirement in Scottsdale, Prescott, or Lake Havasu City

Retiring in a high-cost city means thoughtful financial planning is critical. Here’s a clear step-by-step guide to help you plan:

Step 1: Calculate Your Retirement Budget

Start by estimating annual expenses, including:

- Housing: Mortgage or rent payments, property taxes, insurance, and upkeep.

- Healthcare: Premiums, copays, medications, and specialist visits.

- Food and Everyday Living: Groceries, dining, utilities.

- Transportation: Vehicle costs or public transit.

- Lifestyle: Hobbies, travel, dining out, social activities.

Using online budgeting calculators tailored for these Arizona cities can help generate a realistic picture of needed funds.

Step 2: Take Advantage of Arizona’s Tax Benefits

Arizona offers several tax advantages attractive to retirees:

- A flat state income tax rate of about 2.5% applies to retirement income and pension withdrawals.

- No state tax on Social Security benefits, which can be a big plus.

- No estate or inheritance taxes.

- Military retirees enjoy additional income tax benefits.

These perks can stretch your retirement savings farther than in many other states.

Step 3: Choose Your Neighborhood Wisely

Within these cities, areas vary widely in cost, amenities, and accessibility. Look for neighborhoods that fit your lifestyle preferences and budget, especially considering proximity to healthcare, shopping, and social opportunities.

Step 4: Prepare for Healthcare Needs

Ensure access to good healthcare facilities. Scottsdale particularly shines here with top-ranked hospitals and specialized medical care. Prescott and Lake Havasu City offer quality care but may require trips to larger metro areas for specific treatments.

Step 5: Consider Alternative Housing Options

Many retirees find downsizing or moving to senior-focused communities a smart way to reduce costs and simplify life. These communities often provide social activities, maintenance-free living, and healthcare support.

Retirees Face $18,000 Social Security Cut: What You Need to Know and How to Prepare in 2025

Your SSI Check Might Arrive Sooner in August 2025 — Complete Payment Guide and Schedule

FAQs About Most Expensive Retirement Spots

What makes Scottsdale more expensive than other Arizona cities?

Scottsdale is known for its luxury lifestyle, upscale amenities, premium medical facilities, and high housing prices, contributing to higher overall living expenses.

Can I find affordable retirement options in Arizona?

Yes, Arizona has many affordable towns and cities; however, they may not all offer the same amenities, climate, or lifestyle as the more expensive cities.

What are the tax advantages for retirees in Arizona?

Retirees benefit from a low flat state income tax, no taxation on Social Security benefits, and no estate or inheritance taxes, which can significantly ease retirement finances.

Is healthcare expensive in these cities?

While healthcare services in Scottsdale can be pricier due to the quality and availability of specialists, it often balances out with insurance and Medicare coverage. Prescott and Lake Havasu City provide access but might have fewer specialist options on hand.

What types of activities can retirees enjoy in Prescott and Lake Havasu City?

Retirees can enjoy a strong outdoor lifestyle, including hiking, fishing, boating, and participating in community cultural events.