A legislative proposal for a significant 33% SSS pension increase is advancing in the Philippine Congress, offering potential relief for millions of retirees facing a rising cost of living. However, the proposal is meeting with considerable debate over its financial sustainability, with officials from the Social Security System (SSS) indicating that such a measure would necessitate a corresponding contribution rate hike to protect the fund’s long-term health.

33% SSS Pension Increase in 2025

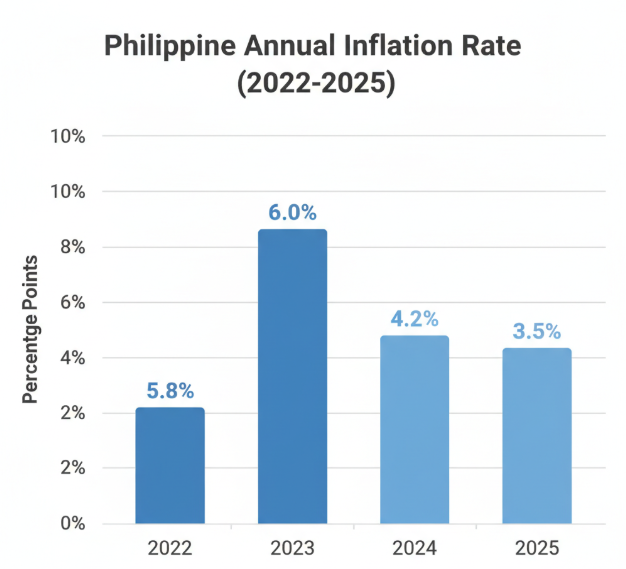

The proposed legislation, debated in several House and Senate committees, aims to provide a more substantial safety net for the nation’s private-sector retirees. Proponents argue that current pension levels have failed to keep pace with inflation, diminishing the purchasing power of pensioners.

| Key Fact | Detail / Statistic |

| Proposed Increase | A tiered increase, potentially up to 33%, to be implemented in stages starting in 2025. |

| Primary Justification | To help pensioners cope with persistent inflation, which the Philippine Statistics Authority (PSA) reported as averaging nearly 6% in 2023. Philippine Statistics Authority (PSA) |

| Funding Mechanism | Primarily through a proposed increase in the member contribution rate, potentially rising from 14% to 15-17% over several years. |

| Current Status | The pension reform bill is pending at the committee level in both legislative chambers; it is not yet law. |

The Debate Over Financial Sustainability

At the heart of the discussion is the actuarial health of the SSS fund. The Social Security System (SSS), a government-owned and controlled corporation, operates a fund based on contributions from its active members and their employers. Officials have repeatedly stated that any benefit payout increase must be matched with a sustainable source of new funding.

In a recent press briefing, SSS President and CEO Rolando L. Macasaet explained the fiscal reality. “While we fully support the goal of improving the welfare of our pensioners, our primary mandate is to ensure the long-term viability of the fund for all members, both current and future,” he said, according to a transcript released by his office. “A pension increase of this magnitude without an adjustment in contributions would shorten the fund’s life significantly.”

Economists have echoed these concerns. Dr. Alvin Ang, a senior economist at the Ateneo de Manila University, commented in an interview that the policy presents a difficult trade-off. “It is a question of inter-generational equity. You provide more for today’s pensioners, but you risk the fund’s ability to provide for tomorrow’s retirees unless everyone contributes more now.”

What the Contribution Rate Hike Could Mean

The most direct impact for the more than 40 million SSS members would be a higher monthly deduction from their salaries. The proposed contribution rate hike is designed to inject the necessary capital into the fund to cover the increased pension payouts.

Arguments for the Hike:

- Ensures Solvency: Proponents state it is the only responsible way to fund the pension increase without bankrupting the system.

- Shared Responsibility: It spreads the cost of improved retiree benefits across the entire base of working members.

Arguments Against the Hike:

- Reduced Take-Home Pay: Opponents, including several labour groups, argue that a higher contribution rate will reduce the disposable income of current workers who are also struggling with inflation.

- Potential Burden on Employers: The increase would also apply to the employer’s share of the contribution, potentially impacting business costs, especially for small and medium-sized enterprises (SMEs).

Legislative Path and Outlook

For the SSS pension increase to become law, the pension reform bill must be approved by both the House of Representatives and the Senate before being sent to the President for signature. The legislative process involves multiple readings and committee-level debates, where amendments are common.

Political analysts suggest the bill has popular support but faces significant legislative and economic hurdles. The final version will likely involve a compromise between the size of the pension increase and the required adjustment in member contributions.

The timeline for implementation remains uncertain and is wholly dependent on the pace of the legislative process. As of the third quarter of 2025, the bill remains under deliberation, with lawmakers aiming to find a balanced solution before the end of the current congressional session. The final form of the law, if passed, will determine the exact amounts and the payment calendar for any adjusted pensions.

State pensioners who’ve hit certain age set to be handed extra £105 a week

Millions to Lose Out on Triple Lock Pension Boost: Fury Grows Over DWP’s Silent Move

BlackRock Just Lost a $17 Billion Deal – What Happened at This Dutch Pension Giant?

FAQs

- Is the 33% SSS pension increase officially approved for 2025?

No. As of September 2025, this is a proposed bill under consideration in the Philippine Congress. It has not been passed into law, and its provisions could change during legislative debates. - If the bill passes, how much will my pension increase?

The “33%” figure represents the maximum proposed increase, which may be implemented in stages. The final amount would depend on the version of the bill that is eventually signed into law. - Will the SSS contribution rate for current members definitely increase?

The SSS has stated that a significant contribution rate hike is the most viable method to fund the proposed pension increase. While not yet law, it is a central part of the current legislative proposal. - When would the increased pension be paid out?

A payment calendar can only be established after a bill is signed into law. Any implementation would likely begin in the fiscal year following the law’s enactment.