The Singaporean government will disburse one-off cash payments of between S200andS400 to eligible adult citizens in September 2025. This measure, part of the enhanced cost-of-living support under the Assurance Package, aims to provide further relief to Singaporean households amid persistent inflationary pressures, according to a statement from the Ministry of Finance (MOF).

Eligible Singaporeans to Receive $200–$400

| Key Information | Details |

| Payment Amount | S200,S300, or S$400 Ministry of Finance |

| Eligibility | Based on 2024 Assessable Income and property ownership |

| Disbursement Date | Late September 2025 |

| Total Beneficiaries | Approximately 2.5 million adult Singaporeans |

Details on the September Cost-of-Living Support Payout

The cash payment is tiered to provide greater support to lower- and middle-income Singaporeans. The eligibility for the September 2025 payment is determined by an individual’s Assessable Income for the Year of Assessment 2024.

According to the MOF, the payment structure is as follows:

- S$400 for citizens with an Assessable Income of up to S$34,000.

- S$300 for citizens with an Assessable Income between S34,001andS100,000.

- S$200 for citizens with an Assessable Income above S$100,000, provided they do not own more than one property.

These payments are the latest in a series of measures rolled out under the Assurance Package. Most eligible citizens will receive the payment directly into their bank accounts via their PayNow-NRIC linked bank account. Those without a linked PayNow-NRIC will have the funds credited to the bank account provided to the government for previous support schemes.

34,000,S34,001-S100,000,>S100,000) and the corresponding cash payout (S400,S300, S$200) for each tier.]

A Key Component of a Broader Support Framework

This payout is part of the government’s S$11 billion Assurance Package, which was first announced in Budget 2020. The package was designed to help offset the impact of the Goods and Services Tax (GST) increase and provide wider support for households. It has since been enhanced to address heightened concerns over the rising cost of living.

In a press release, Deputy Prime Minister and Minister for Finance, Lawrence Wong, stated that the government remains committed to assisting Singaporeans. “We understand the pressures that households are facing from higher living costs,” Mr Wong said. “This targeted support, alongside our other measures, will provide some immediate inflation relief, particularly for the more vulnerable.”

Context: Navigating Global Economic Headwinds

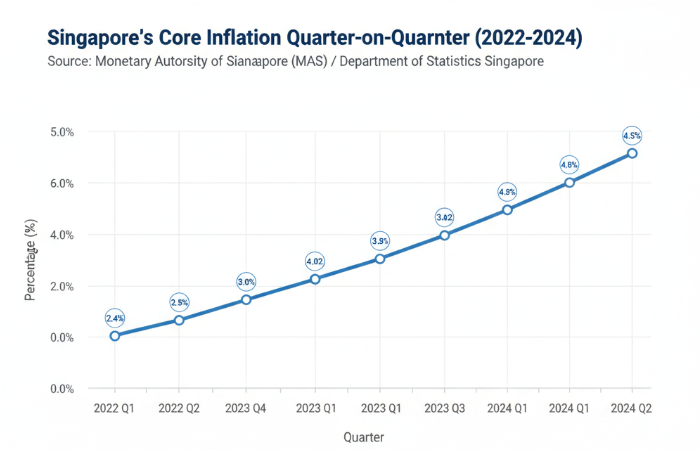

The disbursement comes as Singapore, like many nations, continues to navigate a challenging global economic environment. Data from the Monetary Authority of Singapore (MAS) indicates that while core inflation has eased from its peak, it remains at elevated levels due to global energy prices and persistent supply chain disruptions.

These direct cash payments are a tool used by the government to cushion the impact on domestic consumers without significantly adding to long-term inflationary pressures. Economists note that such direct support helps maintain household purchasing power for essential goods and services.

“Direct cash transfers are an efficient way to deliver aid quickly,” said Dr. Kelvin Tan, a senior economics lecturer at the National University of Singapore, in an interview. “While they do not solve the root causes of inflation, they serve as a critical temporary buffer for families, allowing them to better manage their budgets for daily necessities.”

The government has encouraged all eligible citizens to link their NRIC to PayNow by early September to ensure the swift and secure receipt of the payment. Citizens can check their eligibility for the payout starting from early September via the official Assurance Package e-services portal using their Singpass login.

UK Income Support Rates 2025: Check September Rates, Date & Amount

Big Change in Poundland Pricing Policy to Hit All UK Outlets

FAQs

1. How do I check if I am eligible for the payment?

You can check your eligibility on the official Assurance Package e-services portal from the beginning of September 2025. You will need to log in with your Singpass details to view your eligibility status.

2. What should I do if I do not have a PayNow-NRIC linked bank account?

If you do not have PayNow linked to your NRIC, the payment will be credited to the bank account you most recently provided to the government for other support schemes. To receive the payment faster, you are encouraged to link your NRIC to PayNow with a participating bank.

3. Is this cost-of-living support payment taxable?

No, this payment is not taxable. It is a one-off support measure provided by the government to help with living expenses.