Hundreds of thousands of pensioners with disabilities across the United Kingdom may see their financial support increase next year, with projections indicating the higher rate of Attendance Allowance could reach £110.40 per week. This article explains the eligibility criteria for the £110.40 Attendance Allowance in September 2025, how the rate is determined, and the process for making a claim.

£110.40 Attendance Allowance in September 2025

| Key Fact | Details |

| Projected Higher Rate (2025/26) | £110.40 per week |

| Current Higher Rate (2024/25) | £108.55 per week GOV.UK |

| Who Can Claim? | Individuals over State Pension age with a disability requiring care. |

| Is it Means-Tested? | No. Income and savings do not affect eligibility. |

Understanding the Potential Rate Increase

Attendance Allowance is a benefit administered by the Department for Work and Pensions (DWP) designed to help individuals over the State Pension age with the extra costs associated with a long-term physical or mental disability. Each April, benefits are uprated, typically in line with the previous September’s inflation figure, measured by the Consumer Prices Index (CPI).

While the official confirmation will be delivered by the Chancellor in the Autumn Statement, current economic forecasts suggest an inflationary increase that would raise the higher weekly payment from its current £108.55 to approximately £110.40. The lower rate is also projected to rise from £72.65 to around £73.85.

“These annual adjustments are crucial for ensuring that financial support for vulnerable pensioners keeps pace with the rising cost of living,” stated a spokesperson for Age UK, a leading charity for older people. “It is vital that everyone who is entitled to this support understands how to claim it.”

Are You Eligible for Attendance Allowance?

Eligibility for this payment is not based on income or savings. Instead, it is determined by the level of help an individual requires with their personal care or supervision to remain safe.

Core Eligibility Criteria

To qualify for Attendance Allowance, an applicant must meet the following conditions, according to official DWP guidance:

- Be over State Pension age. This age is currently 66 for both men and women in the UK.

- Have a physical or mental disability, which can include sensory conditions, learning difficulties, or cognitive impairments.

- Need help with personal care or supervision. This is the central condition. The applicant must require frequent help or constant supervision for their safety or the safety of others.

- Have needed this help for at least six months. This requirement is waived for individuals who are terminally ill.

It is a common misconception that you must have a carer to be eligible. The assessment is based on the help you need, not whether you actually receive it.

The Two Payment Rates Explained

The amount of Attendance Allowance you receive depends on the level of care you need.

- Lower Rate: Awarded if you need frequent help or constant supervision during the day, or supervision at night.

- Higher Rate: Awarded if you need help or supervision throughout both the day and night, or if you are certified by a medical professional as having 12 months or less to live.

How to Navigate the Claiming Attendance Allowance Process

The application for Attendance Allowance involves detailing how your disability affects your daily life. It is crucial to be thorough and provide specific examples.

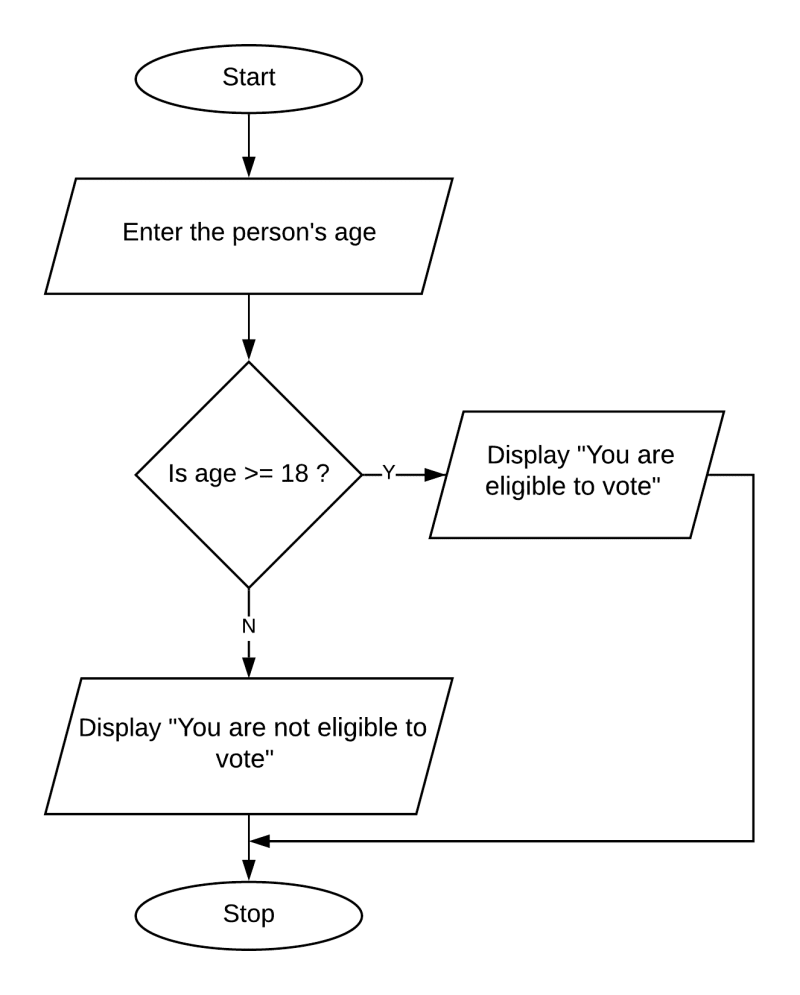

The process for claiming Attendance Allowance is as follows:

- Obtain the Claim Form (AA1): This can be downloaded from the GOV.UK website or requested by calling the Attendance Allowance helpline.

- Complete the Form: The form asks for detailed information about your condition and the specific difficulties you face with tasks such as washing, dressing, eating, and moving around. It is advisable to explain the impact on both good and bad days.

- Gather Supporting Evidence: While not mandatory, including evidence from doctors, specialists, or carers can strengthen a claim. This could include appointment letters or a list of prescribed medications.

- Submit the Form: The completed form can be sent by post to the address provided.

“The key to a successful claim is the quality of the information provided on the form,” advises Citizens Advice. “Be explicit about the help you need, how long tasks take, and any accidents or falls you have had. This paints a clear picture for the DWP assessor.”

Impact on Other Benefits

A successful claim for Attendance Allowance can also act as a gateway to other forms of financial support. For example, it may increase the amount you receive from other benefits such as Pension Credit, Housing Benefit, or Council Tax Reduction. It is therefore important for claimants to notify relevant offices if they are awarded Attendance Allowance.

The official rates for the 2025-2026 financial year will be announced by the government later this year. Pensioners and their families are encouraged to monitor announcements from the DWP and to use official government resources to check their Attendance Allowance eligibility and begin the application process if they believe they qualify.

State pensioners who’ve hit certain age set to be handed extra £105 a week

DWP Issues Urgent Warning: The One Week in September That Could Cost Pensioners £300

Cost of Living Help & Pension Payments Coming in September 2025 – Are You on the List?

FAQs

Q1: Is Attendance Allowance taxable?

No, Attendance Allowance is a tax-free benefit. It is not counted as income for tax purposes.

Q2: Will my savings or a private pension affect my claim?

No. Attendance Allowance is not means-tested. Your savings, income, or National Insurance contribution history have no bearing on your eligibility.

Q3: Can I still claim if I live in a care home?

You can usually still get Attendance Allowance if you live in a care home, provided you pay for all your own care home fees. If your care is paid for by the local authority, the benefit typically stops after 28 days.

Q4: What should I do if my condition changes?

You must report any changes in your circumstances to the DWP Attendance Allowance helpline. This includes an improvement or worsening of your condition, or if you go into a hospital or care home.